Car insurance is a “black box.” It’s a mandatory, expensive product that none of us really understand, governed by rules we can’t see. So, what do we do? We fill in the gaps with “common knowledge”—tips we hear from our parents, our friends, or that “car guy” at work. “Red cars cost more,” “You’re covered for a few days on a new car,” “My friend’s insurance will pay.” We nod and accept these myths as fact. But here’s the hard truth: these myths are financial landmines.

As your no-nonsense commuter friend, I’m here to tell you that what you *think* you know about your insurance is probably wrong, and it’s costing you a fortune. Believing these myths can lead you to either *overpay* for coverage you don’t need or, far worse, leave you *dangerously under-insured* in the one moment you actually need it. An insurer’s job is to follow the contract, not what you “assumed” was true. Relying on myths is a gamble you can’t afford to lose.

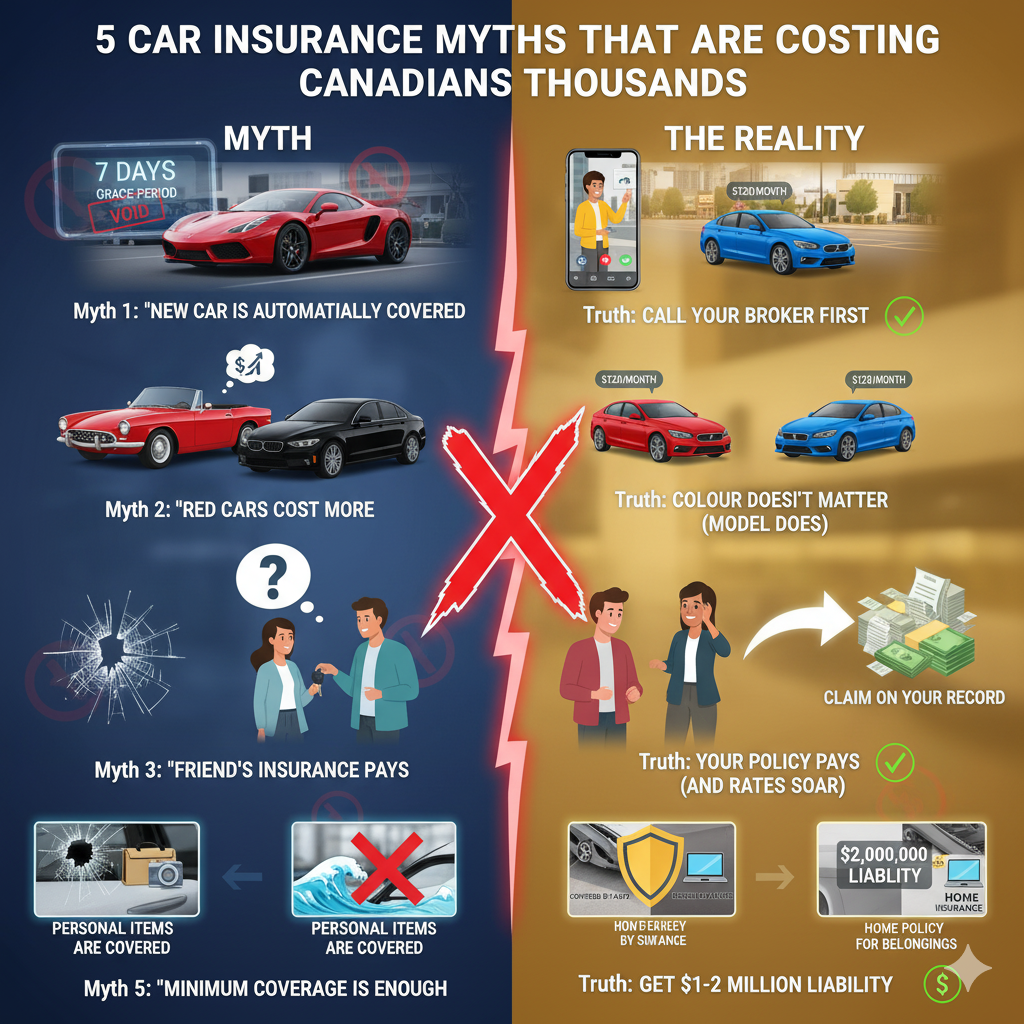

It’s time to turn on the lights. We’re going to bust the 5 biggest and most expensive car insurance myths in Canada. The truth will save you from stress, prevent financial ruin, and put thousands of dollars back in your pocket. Let’s get this handled.

Myth 1: “My new car is automatically covered by my old policy for a ‘grace period’.”

The Truth: This is the most dangerous myth on the entire list. You assume you have a 7-day or 14-day “grace period” to sort out your insurance after you buy a new car. This is a terrifyingly dangerous assumption.

In reality, any “automatic” coverage for a newly-acquired vehicle is extremely limited. It might only be 24-48 hours, or it might only be for the *exact* level of coverage you had on your old car (which is useless if you traded your 15-year-old beater for a $50,000 new SUV). You must call your broker or insurer *before* you drive that new car off the lot. If you get in an accident on the way home, you risk being 100% uninsured, personally liable for the full value of the car you just “bought.”

Myth 2: “Red cars cost more to insure.”

The Truth: This is 100% false. It’s the most famous car myth of all time, and it has zero basis in reality. Your insurance company does not care about the *colour* of your car. They cannot even *see* the colour on the Vehicle Identification Number (VIN).

What they do care about is the car’s statistical profile:

- Make and Model: (e.g., Honda Civic vs. Porsche 911)

- Engine Size: (A 4-cylinder vs. a V8)

- Repair Cost: (How much does a new bumper and sensor cost?)

- Theft Rate: (Is your Honda CR-V a top target for thieves?)

A red Ford Mustang is expensive to insure because it’s a *Mustang*—a high-horsepower sports car with a high accident rate—not because it’s *red*. A red Toyota Corolla costs the exact same to insure as a black, white, or beige one. This myth is pure fiction.

Myth 3: “If my friend borrows my car and crashes, *their* insurance pays.”

The Truth: This is a critical, friendship-ending mistake. The golden rule of Canadian insurance is simple and absolute: Insurance follows the CAR, not the DRIVER.

When you lend your keys to a friend (who is a licensed driver), you are not just lending them your car; you are lending them your *entire insurance policy* and your *clean driving record*. If your friend runs a red light and causes a $75,000 accident, it is your policy that pays the claim. It is your record that gets the “at-fault” accident. And it is your premium that will skyrocket for the next 3-6 years. Never, ever lend your car lightly.

Myth 4: “My insurance covers personal items stolen *from* my car.”

The Truth: This is a very painful, and very common, misunderstanding. Your auto insurance policy and your home/tenant insurance policy cover two completely different things.

- Your auto insurance (specifically Comprehensive coverage) pays for items that are *part of the car*. If a thief smashes your window and steals your built-in navigation system or your catalytic converter, your auto policy pays.

- Your homeowner’s or tenant’s insurance pays for your *personal belongings*. If that same thief steals your $2,000 laptop, your $1,000 phone, or your $3,000 camera bag from the trunk, your auto insurance will pay *$0* for those items. You must make a claim on your *home* policy, which is subject to a different deductible.

This is one of the worst car insurance myths because people only learn the truth *after* they’ve been robbed.

Myth 5: “I’m a great driver, so I only need the legal minimum liability coverage.”

The Truth: This is not “saving money”; it is financial suicide. The legal minimum liability in most provinces (like the $200,000 in Ontario or Alberta) is a number that was set *decades* ago. It is terrifyingly inadequate in 2026.

Think about it: a modern, multi-car accident can easily result in life-altering injuries. A lawsuit for pain, suffering, and a lifetime of lost income for just *one person* can easily reach $1,000,000 or $2,000,000. Your “minimum” $200,000 coverage is gone in an instant. The other party’s lawyers will then seize your house, your savings, and garnish your wages for the rest of your life. The cost to upgrade your policy from the $200,000 minimum to $1,000,000 (or $2,000,000) is usually just a few dollars a month. It is the single best-value purchase you can make.

Myths are expensive. The truth is that your insurance policy is a cold, hard legal contract. It’s your *job* as a smart, no-nonsense consumer to know what’s in it. Don’t rely on “common knowledge.” Read your policy, ask your broker these tough questions, and stop paying for myths. Being a good driver is only half the battle; being a smart owner is what saves you.

Frequently Asked Questions (FAQs)

1. Will a parking ticket affect my insurance?

No. Parking tickets (and red-light camera tickets) are “non-moving violations” issued to the *plate*, not the *driver*. They do not go on your driving record and are invisible to your insurer. Just pay the fine and forget it.

2. Is it true my credit score can affect my insurance?

Yes. This is a myth that is actually *true* (in most of Canada). In provinces like Alberta (but *not* in Ontario or Newfoundland), insurers are legally allowed to use your credit score as a risk-prediction tool. Statistically, people with lower credit scores are more likely to make a claim. It’s a controversial practice, but it’s real.

3. I don’t need to tell my insurer I’m using my car for Uber or DoorDash, right?

This is a massive myth. The second you use your car for *any* commercial purpose (like ride-sharing or food delivery), your personal policy is 100% void. If you get in an accident while “on the job,” your insurer will deny your claim instantly, leaving you personally liable for everything. You *must* have a special “ride-sharing” add-on to your policy.

4. My car is 15 years old. It’s not a theft target, right?

False. Your 15-year-old Honda Civic or 20-year-old pickup truck is a *massive* theft target. New cars have complex anti-theft technology. Your old car can be stolen in 30 seconds with a screwdriver. They are stolen, driven to a “chop shop,” and stripped for parts. An old car is often a *bigger* theft risk, not a smaller one.

5. Does “Accident Forgiveness” mean a speeding ticket won’t raise my rates?

No. These are two different things. “Accident Forgiveness” is a policy add-on that “forgives” your *first at-fault ACCIDENT*. A *speeding ticket* is a “conviction,” not an accident. That conviction will still go on your record and can still raise your rates. They are separate.