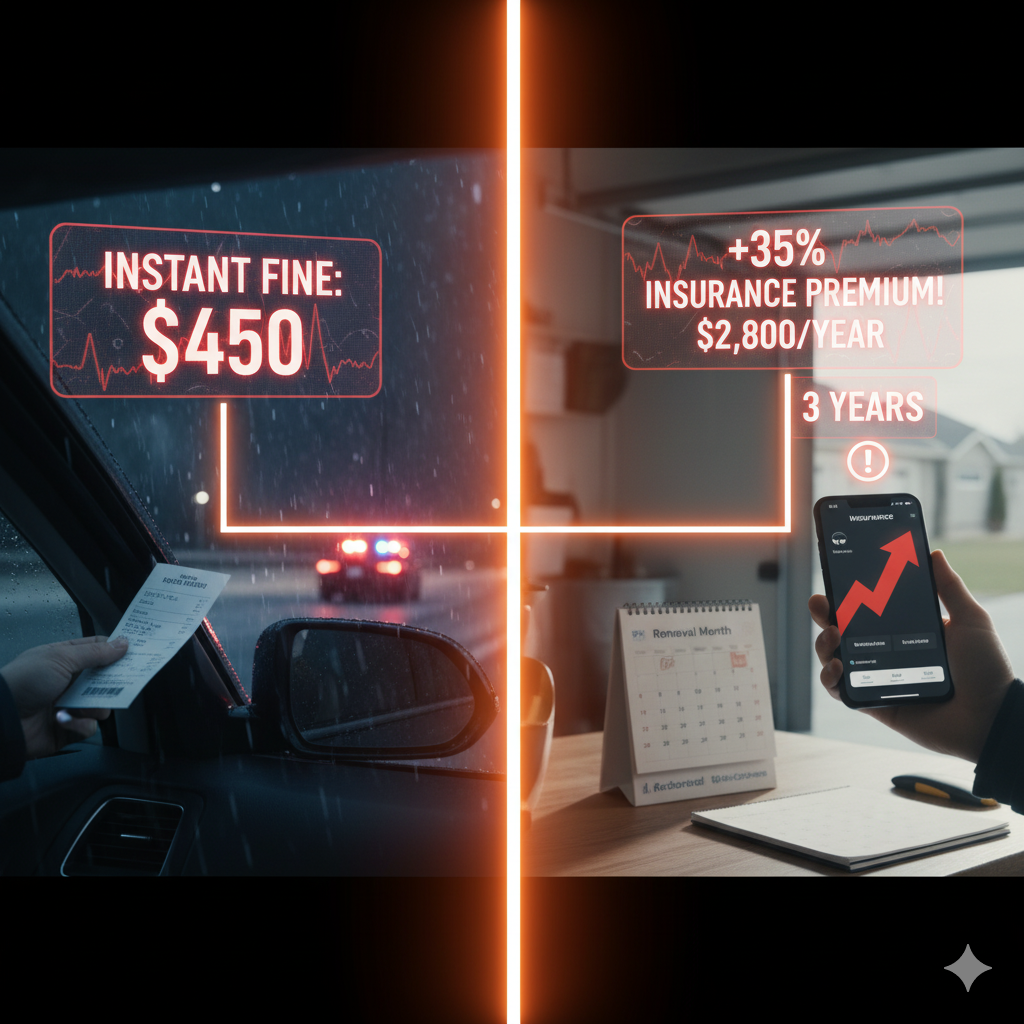

It’s that moment your heart sinks into your stomach: you see the flashing red and blue lights in your rearview mirror. You’ve been caught. The immediate pain is the officer writing you a fine that will cost you hundreds of dollars. But the *real* fear—the one that lasts much longer—is the second-wave attack: your insurance renewal. Will your rates double? Does one small ticket even matter? Or did you just make a multi-thousand-dollar mistake?

This uncertainty is where the anxiety comes from. The system is intentionally confusing. You hear myths from friends: “My brother got three tickets and his rates never went up,” or “One ticket and my insurer dropped me!” You’re left guessing, and that’s a terrible feeling. As your no-nonsense commuter friend, I’m here to tell you the truth. The answer isn’t a simple “yes” or “no.” It depends on a critical, and often misunderstood, factor: the *type* of ticket you got.

We are going to cut through all the myths. We’ll break down exactly what insurers see, how long it *really* haunts your record, and the massive financial difference between a “minor” slip-up and a “major” conviction. This is the no-BS truth about the real cost of that ticket.

The Short Answer: Yes, But Not All Tickets Are Created Equal

Let’s get this out of the way: Yes, a speeding ticket *can* and *will* raise your insurance. But the impact is not equal. Insurance companies are not in the business of punishment; they are in the business of “risk calculation.” When you get a ticket, they don’t just see a fine; they see a data point that proves you are a riskier driver than you were yesterday.

But they’re not unreasonable. A single, very minor ticket on an otherwise spotless 10-year record? Many insurers will “forgive” it or the impact will be minimal. What they are *really* looking for is a pattern of risk (multiple minor tickets) or a catastrophic risk (one single, major ticket). This is the most important distinction you need to understand.

Minor vs. Major: The Two Classes of Conviction

To an insurer, there are two types of tickets, and the difference between them is everything.

1. Minor Convictions (The “Annoyance”)

These are the most common tickets. They are an annoyance and a warning sign.

- Examples: Speeding 1-49 km/h over the limit (in most of Canada), failing to signal, rolling a stop sign, or an improper turn.

- The Impact: The *first* minor ticket on a long, clean record is often survivable. Your insurer may “forgive” it or you might lose a “clean record” discount, resulting in a small 5-10% bump. But a *second* or *third* minor ticket in a 3-year period is a huge red flag. This proves a *pattern* of risky driving. This is when your rates will jump significantly (25%+) and you’ll lose all your “good driver” perks.

2. Major & Serious Convictions (The “Financial Killers”)

These are the tickets that change your life. They signal a *deliberate* and dangerous disregard for the rules.

- Examples: Speeding 50+ km/h over the limit, “Stunt Driving” or “Racing” (a massive one in Ontario), speeding in a school or construction zone, or (the new big one) any ticket for “Distracted Driving” (using your phone).

- The Impact: This is not a “small bump.” A single major conviction can increase your *entire* premium by 25%, 50%, or even 100%. Many standard insurance companies will drop you entirely at your next renewal, forcing you to find “high-risk” insurance, which can cost three or four times as much.

The “3-Year Rule” and the “Conviction Date”

This is the part that tricks everyone. A ticket doesn’t just “go away.”

A conviction (minor or major) stays on your insurance record for three full years. But here’s the catch: that 3-year clock does *not* start on the day the officer gave you the ticket. It starts on the “conviction date”—the day you either pay the fine (which is an admission of guilt) or are found guilty in court.

This is why people “fight” tickets. If you can delay your court date for a year, you have delayed the start of that 3-year insurance penalty by a year. If you can get it delayed until *after* an older ticket has “fallen off” your 3-year window, you may have just saved yourself from being rated as a “repeat offender.”

The Big Myth: “Demerit Points vs. Insurance”

Let’s be perfectly clear: Your insurance company does not care about your demerit points.

Demerit points are a separate system used by the provincial government (like the Ministry of Transportation) to track your driving and decide when to *suspend your license*. That’s it.

Your insurer cares about one thing: the conviction itself.

- In Ontario, a 15 km/h over ticket might get you 0 demerit points.

- A 30 km/h over ticket might get you 4 demerit points.

To your insurance company, in most cases, *both of those are treated as the exact same “minor conviction.”* Do not be fooled into thinking a “0 point” ticket is a “no-risk” ticket. It is not. It will still show up on your record.

Good News: Red-Light Cameras & Photo Radar

Finally, some good news. That ticket you got in the mail from a red-light camera or a photo radar (speed) camera? You can pay it and sleep easy.

In Canada (including Ontario and Alberta), these tickets do not affect your insurance premium. Why? Because they are a ticket issued to the *owner of the license plate*, not the *driver*. The camera cannot prove *who* was driving the car. Since there is no driver to assign a “conviction” to, it does not go on your driving record and is invisible to your insurer. Just pay the fine and forget about it.

What to Do After You Get Pulled Over

- Don’t Just Pay It (Yet): Paying the fine is an instant, automatic guilty plea. That *is* your conviction. You’ve just started the 3-year clock.

- Check for Errors: Look at the ticket. Is your license plate number wrong? Is the street or location incorrect? A “fatal error” on the ticket can be grounds for dismissal.

- Talk to a Paralegal: For a “major” ticket, this is non-negotiable. For a “minor” ticket (especially if you have another one on your record), it’s a very smart idea. For a few hundred dollars, a paralegal (like X-Copper, etc.) can often negotiate your “minor” moving violation (speeding) down to a “non-moving” violation (like a parking or bylaw infraction). A non-moving violation is *invisible* to your insurer. You pay the fine, but you save thousands on your insurance.

- Brace for Renewal: If you are convicted, the pain won’t show up right away. It will hit you on your *next renewal date*. This gives you 6-12 months to budget for the increase or to start shopping around.

A speeding ticket isn’t just a one-time fine. Think of it as a 3-year loan you’ve just been forced to take from your insurer. The hard truth is that “one ticket” won’t *ruin* you, but one *major* ticket or a *pattern* of minor ones absolutely will. The most practical, no-nonsense advice? Slow down and put the phone in the glove box. A clean driving record is the only “discount” you 100% control.

Frequently Asked Questions (FAQs)

1. How long does it take for a ticket to show up on my insurance?

It will appear on your *next policy renewal* after the conviction date. Insurers pull your driving record (MVR) once a year, just before they send you your new offer. A conviction in July will almost certainly show up on a January renewal.

2. Will my “Accident Forgiveness” coverage protect me from a speeding ticket?

No. “Accident Forgiveness” is a policy add-on that protects your rates from your *first at-fault accident*. It has absolutely no effect on convictions from speeding tickets or other moving violations.

3. My ticket was 0 demerit points. Are you *sure* my insurance will go up?

Yes. Insurers do not care about points. They care about the *conviction*. A 0-point speeding ticket is still a “minor conviction” and will be treated as such by their risk model. It is not a “freebie.”

4. I got a speeding ticket in Quebec. Will my Ontario/Alberta insurer find out?

Yes. Provinces have reciprocal agreements to share driving records. A ticket you get while on vacation in another province (or in most U.S. states) will absolutely follow you home and will appear on your driving record for your insurer to see.

5. What’s worse for my insurance: one at-fault accident or one *major* speeding ticket?

Both are terrible. But a major conviction (like “Stunt Driving” or “Distracted Driving”) is often *worse*. An at-fault accident can be seen as a “one-time mistake.” A major conviction proves a *deliberate habit* of high-risk, dangerous driving, which is the scariest thing in the world to an insurer.