You’ve just had a child, or your kid is starting to grow up, and that distant, challenging thought hits you: “How am I going to pay for their education?” You look at the future cost of a university or college education—projected to be well over $100,000 for a four-year degree—and it feels impossible. You’re not a financial expert. Where do you even begin? This anxiety is so overwhelming that most people just… don’t. They put it off for “later.”

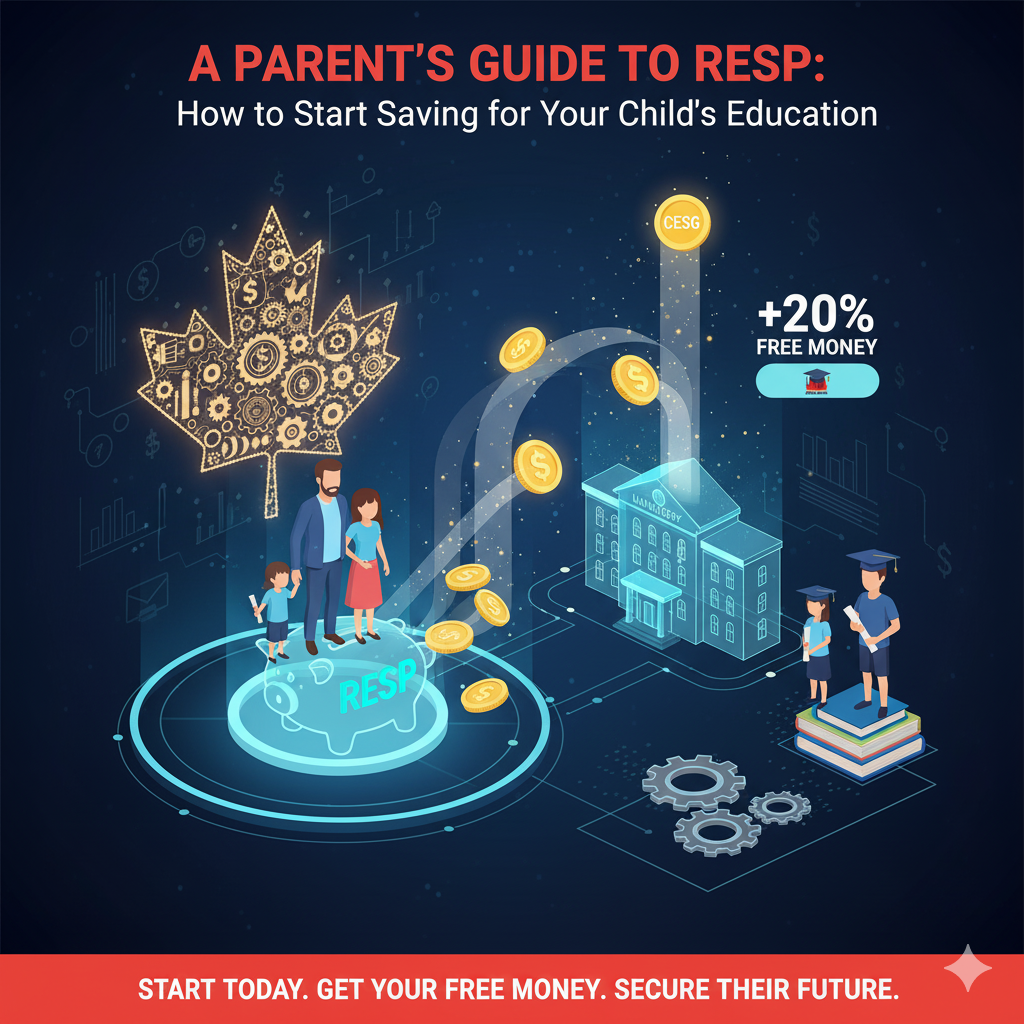

Here’s the hard, no-nonsense truth: “later” is the most expensive word in finance. But you don’t need to be a Wall Street genius to solve this. The Canadian government has created an exceptional co-investment program. It’s called a RESP (Registered Education Savings Plan), and it’s not just a “savings account.” It’s a “money-multiplier” that provides significant government grants for your child’s future.

As your no-nonsense career advisor, I’m here to be your translator. We’re going to ignore the confusing jargon. This is your simple, step-by-step guide to understanding the RESP, what it is, and (most importantly) how to set one up *today* to start securing these valuable government benefits. Let’s get this handled.

What is an RESP (And What’s the “Magic” Part)?

An RESP is a “Registered Education Savings Plan.”

In simple terms, it’s a special, tax-sheltered investment account you open “in trust” for your child (the “beneficiary”). You put money in, that money grows 100% tax-free, and your child can use it for *any* qualified post-secondary education (college, university, trade school).

That’s all good. But here is the “magic” part. It’s an acronym you *must* know: **CESG**.

The Government Co-Investment Explained: The CESG (The 20% Bonus)

The **CESG** stands for the **Canada Education Savings Grant**.

This is not a “maybe.” This is not a “draw.” This is a guaranteed, automatic deposit from the Government of Canada for eligible contributions.

Here is how it works: For every dollar you contribute to your child’s RESP, the government will automatically deposit an extra 20% into the account, up to a maximum of **$500 per year**.

Let’s make that practical:

- You put in $100. The government adds $20.

- You put in $1,000. The government adds $200.

- To get the *maximum* government grant, you contribute $2,500 in a year. The government will deposit $500.

There is no other investment on Earth that gives you a guaranteed 20% “match” on your savings. This is why an RESP is a total no-brainer. The lifetime maximum benefit you can get from the CESG is **$7,200 per child**. Your only job as a parent is to figure out how to get all of it.

Where to Open an RESP (The Most Important Decision You’ll Make)

This is where new parents make their biggest mistake. Not all RESPs are created equal. There are two main types of providers. One is flexible. The other is often a trap.

1. Group Scholarship Plans (The “Trap”)

You’ve probably heard of these. They have “scholarship” in the name (like “Canadian Scholarship Trust Plan,” “Herizon,” etc.). They often have salespeople who will call you.

The No-Nonsense Truth: As your advisor, I am telling you to be *extremely* careful. These “group plans” are almost always a bad deal. They have complex rules, very high hidden fees, and strict payment schedules. If you miss a payment or your child’s plans change, you can face massive penalties and even lose some of your contributions. Avoid them.

2. Individual or Family Plans (The “Smart Choice”)

This is what you want. You can get these from:

- Your Bank: (RBC, TD, Scotiabank, BMO, CIBC, etc.)

- A “Robo-Advisor”: (like Wealthsimple or Justwealth)

These plans put you in control.

- You decide how much to contribute. (You can put in $50 one month and $500 the next. No penalties.)

- The fees are low and transparent.

- They are flexible. (Your child can go to any school, anywhere.)

Pro-Tip: If you have (or plan to have) more than one child, open a “Family Plan.” This lets you pool all the money in one account, and the children can share the funds. It’s much simpler to manage.

What Should I “Invest” In Inside the RESP?

Your RESP is an investment account, not just a savings account. You have options.

1. The “Easy / Hands-Off” Strategy

This is the “set it and forget it” move. Don’t try to pick stocks. Just buy a single **”Target-Date” Education Fund** (e.g., “CIBC Target Education 2042”). You tell the bank your child’s graduation year (2042), and the fund *automatically* and *gradually* moves from “risky” growth investments (when your child is young) to “safe” cash-like investments (as they get close to Grade 12). It’s the perfect, simple solution.

2. The “I’m Too Nervous to Invest” Strategy

Are you terrified of the stock market? Fine. Open your RESP at your bank and just buy **GICs (Guaranteed Investment Certificates)** or put the money in a high-interest savings account *inside* the RESP.

You will earn very little interest, but guess what? You will *still* get the 20% CESG. A 20% guaranteed return is the main prize. Don’t let your fear of “investing” stop you from getting your $500 annual grant.

What Can My Child Use the Money For?

This is the best part: it’s incredibly flexible. The money (your contributions + the CESG grants + all the tax-free growth) can be used for *any* “post-secondary” school, including:

- University

- College

- Trade School (for an apprenticeship)

- CÉGEP

And the money isn’t just for tuition. Your child (who receives the money as an “EAP” – Educational Assistance Payment) can use it for:

- Tuition

- Books and supplies

- A new laptop

- Rent

- A bus pass

Your 3-Step “No-Nonsense” Action Plan

This isn’t hard. You can do this in one afternoon.

- Get a SIN for Your Child: The one piece of paperwork you need. You must have a Social Insurance Number for your child (the “beneficiary”) to open the account.

- Go to Your Bank: Walk in and say these words: “I would like to open a self-directed Family RESP for my child.”

- Set Up an Automatic Contribution: To get the *maximum* $500 grant, you need to contribute $2,500 per year.

The magic number is $208.33.

Set up an *automatic transfer* of $208.33 from your chequing account to your new RESP every month.

That’s it. You’re done. For the price of a few streaming services and a couple of lattes, you have guaranteed that your child will get the full $7,200 in government grants. You’re not just “saving”; you’re building their future, tax-free. Stop waiting. Do it this week.

Frequently Asked Questions (FAQs)

1. What if my child decides not to go to school?

This is the #1 fear. You do *not* lose your money. 1) All the money *you* contributed is returned to you, 100% tax-free. 2) The “grants” (the CESG) are returned to the government. 3. The “growth” (interest) can be transferred tax-free to your *own* RRSP (if you have room) or withdrawn (but you’ll pay tax on it). It’s not a “loss.”

2. What if I’m a low-income family and can’t afford $208/month?

The government has an *extra* program for you called the **Canada Learning Bond (CLB)**. If you qualify (based on your net income), the government will deposit an *initial $500* into your child’s RESP, and $100 every year, *even if you don’t contribute a single dollar yourself*. It’s a 100% supplemental benefit.

3. What’s the lifetime contribution limit for an RESP?

The lifetime *contribution* limit (what *you* can put in) is $50,000 per child. The lifetime *grant* limit (what *they* put in) is $7,200 per child (from the CESG).

4. Can grandparents or relatives open an RESP?

Absolutely. Anyone can open an “individual RESP” for a child. Or, grandparents can simply give the parents the money to contribute to the *existing* family RESP. This is a fantastic gift.

5. When is the best time to start?

Today. The day your child is born and has a SIN. The most powerful force in an RESP is not just the 20% grant; it’s *time*. The earlier you start, the more “compound growth” (interest on your interest) you will get, all 100% tax-free.